PD-(L)1 Inhibitors Market Set to Surge During the Forecast Period (2025–2034) as Immuno-Oncology Therapies Gain Momentum | DelveInsight

PD-1 inhibitors are projected to dominate future drug sales. Immuno-oncology therapies, particularly the PD-(L)1 class, have revolutionized cancer care across a wide range of tumor types and disease stages, from early-stage to metastatic settings. Their widespread adoption is fueled by demonstrated flexibility, as they can be administered alone or combined with targeted agents such as tyrosine kinase inhibitors, chemotherapy, or other immunotherapies. This adaptability has delivered lasting tumor responses and extended survival, while keeping toxicity levels within manageable limits.

New York, USA, Aug. 18, 2025 (GLOBE NEWSWIRE) -- PD-(L)1 Inhibitors Market Set to Surge During the Forecast Period (2025–2034) as Immuno-Oncology Therapies Gain Momentum | DelveInsight

PD-1 inhibitors are projected to dominate future drug sales. Immuno-oncology therapies, particularly the PD-(L)1 class, have revolutionized cancer care across a wide range of tumor types and disease stages, from early-stage to metastatic settings. Their widespread adoption is fueled by demonstrated flexibility, as they can be administered alone or combined with targeted agents such as tyrosine kinase inhibitors, chemotherapy, or other immunotherapies. This adaptability has delivered lasting tumor responses and extended survival, while keeping toxicity levels within manageable limits.

DelveInsight’s PD-(L)1 Inhibitors Market Forecast report includes a comprehensive understanding of current treatment practices, emerging PD-(L)1 inhibitors, market share of individual therapies, and current and forecasted PD-(L)1 inhibitors market size from 2020 to 2034, segmented into 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan].

Key Takeaways from the PD-(L)1 Inhibitors Market Report

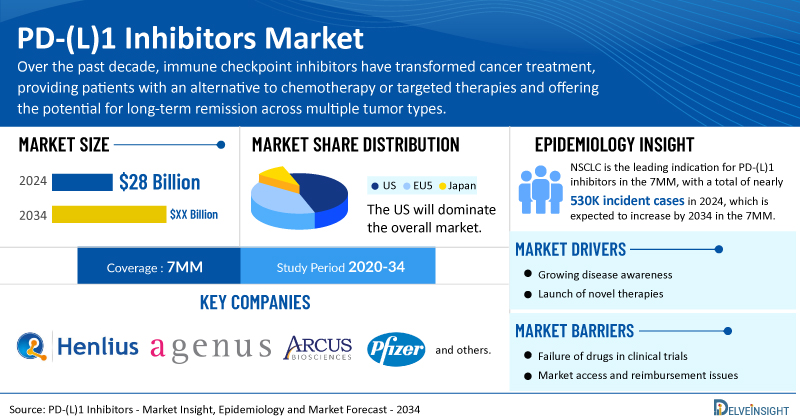

- As per DelveInsight’s analysis, among the 7MM, the United States captured the largest market size of PD-(L)1 inhibitors, with nearly USD 28 billion in 2024, which is projected to increase during the forecast period (2025–2034).

- The report provides the total potential number of patients in the indications, such as Melanoma, Non-small-cell lung cancer, Small-cell lung cancer (SCLC), Head and Neck Cancer, Colorectal Cancer, Renal Cell Carcinoma, Hepatocellular carcinoma (HCC), Triple Negative Breast Cancer, Gastric Cancer/Esophageal Cancer, Biliary Tract Cancer, Urothelial Carcinoma, Basal Cell Carcinoma, Cutaneous Squamous Cell Carcinoma, and others.

- Leading PD-(L)1 inhibitors companies such as Shanghai Henlius Biotech, Agenus, Arcus Biosciences, Pfizer, and others are developing novel PD-(L)1 inhibitors that can be available in the market in the coming years.

- Some of the key PD-(L)1 inhibitors in the pipeline include HLX43, Balstilimab, Zimberelimab, Sasanlimab, and others.

- Sasanlimab is expected to be launched in 2026 and is anticipated to generate a revenue of more than USD 2 million in the launch year.

- In June 2025, Shanghai Henlius Biotech announced that the first subject had been dosed for HLX43-NSCLC201, a phase II international multicenter clinical trial of HLX43, developed by the company based on collaboration with MediLink Therapeutics, for the treatment of patients with advanced NSCLC.

- In June 2025, Agenus announced that it had signed definitive partnership agreements with Zydus Lifesciences to accelerate clinical development, scale global manufacturing, and expand patient access to botensilimab and balstilimab (BOT/BAL).

- In April 2025, Pfizer announced results from the pivotal Phase III CREST trial of sasanlimab, an investigational anti-PD-1 monoclonal antibody, in combination with standard of care (SOC) Bacillus Calmette-Guérin (BCG) as induction therapy with or without maintenance in patients with BCG-naïve, high-risk non-muscle invasive bladder cancer (NMIBC).

Discover which therapies are expected to grab the PD-1 and PD-L1 inhibitors market share @ PD-(L)1 Inhibitors Report

PD-(L)1 Inhibitors Market Dynamics

The PD-(L)1 inhibitors market has evolved into one of the fastest-growing segments in oncology, driven by the rapid adoption of immune checkpoint inhibitors as a standard-of-care for multiple cancer types. The PD-1 and PD-L1 pathways play a critical role in tumor immune evasion, and the introduction of drugs such as pembrolizumab, nivolumab, atezolizumab, durvalumab, and cemiplimab has transformed cancer therapy. Initially approved for melanoma and NSCLC, these agents now have expanded indications across urothelial carcinoma, renal cell carcinoma, head and neck squamous cell carcinoma, triple-negative breast cancer, and more, significantly widening their commercial potential.

Market growth is fueled by strong clinical data, high unmet medical needs, and the increasing trend toward combination therapies. Companies are exploring PD-(L)1 inhibitors in synergy with chemotherapy, targeted therapies, and other immunotherapies to enhance efficacy and overcome resistance. This has led to a surge in clinical trials targeting both first-line and later-line settings, with an emphasis on earlier disease stages and adjuvant/neoadjuvant use. The market is also benefiting from growing biomarker-driven patient selection, such as PD-L1 expression testing and tumor mutational burden assessment, which improve treatment precision and cost-effectiveness.

Competition and market share dynamics are intense, with established players like Merck & Co., Bristol Myers Squibb, Roche, AstraZeneca, and Regeneron dominating the space. Merck’s KEYTRUDA has emerged as the market leader, leveraging broad label expansions and a vast trial network. However, biosimilar and next-generation PD-(L)1 entrants from companies in China and other emerging markets are starting to pressure prices, particularly as patents expire in the early 2030s. Additionally, domestic PD-(L)1 drugs in China, such as those from Innovent Biologics and BeiGene, are rapidly gaining share in their home markets through aggressive pricing and government reimbursement inclusion.

Despite the strong outlook, the market faces challenges and saturation risks. Competition among similar mechanisms can limit differentiation, while high therapy costs raise payer scrutiny, especially in cost-conscious markets. Furthermore, not all patients respond to PD-(L)1 therapy, and resistance, both primary and acquired, remains a clinical barrier. This is prompting research into novel biomarkers, alternative checkpoint targets, and bispecific antibodies to sustain growth and clinical relevance.

Looking ahead, the PD-(L)1 inhibitors market will likely see continued expansion through label broadening, earlier-line adoption, and integration into multi-drug regimens. However, growth rates may moderate as competition intensifies and payers demand stronger cost-effectiveness evidence. Strategic alliances, regional partnerships, and innovation beyond monotherapy will be key levers for companies aiming to maintain leadership in this increasingly crowded and high-stakes oncology market.

PD-(L)1 Inhibitors Treatment Market

In recent years, cancer immunotherapy has made significant strides, with several treatments securing US FDA approval. The PD-(L)1 pathway plays a crucial role in enabling tumors to evade immune system attack, making it an attractive therapeutic target. The emergence of anti-PD-1 and anti-PD-L1 agents has ushered in a new era of cancer treatment. These therapies have shown promising clinical activity across multiple tumor types, with more results anticipated from ongoing and completed trials. Notable PD-1 inhibitors include KEYTRUDA, OPDIVO, LIBTAYO, JEMPERLI, ZYNYZ, LOQTORZI, and TEVIMBRA, while PD-(L)1 inhibitors include TECENTRIQ, BAVENCIO, UNLOXCYT, and IMFINZI. Both drug classes are used in the treatment of various cancers.

Merck’s KEYTRUDA became the first PD-1 inhibitor approved in the US in September 2014, initially for metastatic melanoma. Its growth is now fueled by wider global adoption in earlier-stage cancers, such as triple-negative breast cancer, renal cell carcinoma, and NSCLC in the US, alongside strong global demand in metastatic indications. OPDIVO + YERVOY and KEYTRUDA combined with axitinib have become established first-line treatments for metastatic renal cell carcinoma. OPDIVO has also been approved in combination with cisplatin and gemcitabine for first-line treatment of unresectable or metastatic urothelial carcinoma.

When KEYTRUDA’s exclusivity ends in 2028, biosimilar competition is expected to significantly affect the PD-(L)1 market. In preparation, Bristol Myers Squibb has developed a subcutaneous version of OPDIVO, which received US FDA approval in December 2024 in combination with Halozyme’s recombinant human hyaluronidase.

Learn more about the PD-L1 inhibitor drugs @ FDA Approved PD-L1 Inhibitors

Key Emerging PD-(L)1 Inhibitors and Companies

Some of the drugs in the pipeline include sasanlimab (Pfizer), HLX43 (Shanghai Henlius Biotech), Balstilimab (Agenus), spartalizumab (Novartis), zimberelimab (Arcus Biosciences), and others.

Sasanlimab is a humanized IgG4 monoclonal antibody that targets the PD-1 receptor, blocking its interaction with PD-1 ligands. Pfizer is currently conducting the pivotal Phase III CREST study of sasanlimab in patients with non-muscle invasive bladder cancer (NMIBC).

In April 2025, Pfizer reported results from the Phase III CREST trial, evaluating sasanlimab, an investigational anti-PD-1 antibody, combined with standard-of-care Bacillus Calmette-Guérin (BCG) as induction therapy, with or without maintenance, in BCG-naïve, high-risk NMIBC patients. Earlier, in January 2025, the company had announced positive topline findings from the same trial.

HLX43, an antibody–drug conjugate (ADC) targeting PD-L1, is advancing to global Phase II clinical development. It has secured IND approvals from both China’s National Medical Products Administration (NMPA) and the U.S. FDA. HLX43 is being assessed in Phase II studies for multiple solid tumors, including NSCLC, thymic squamous cell carcinoma, hepatocellular carcinoma, esophageal squamous cell carcinoma, head and neck squamous cell carcinoma, cervical cancer, and nasopharyngeal cancer.

In June 2025, Shanghai Henlius Biotech announced dosing of the first patient in HLX43-NSCLC201, a Phase II international multicenter study for advanced NSCLC. Developed in collaboration with MediLink Therapeutics, HLX43, previously demonstrated in its Phase I trial, presented at the 2025 ASCO Annual Meeting, a manageable safety profile and promising efficacy across several tumor types, particularly in NSCLC subgroups (squamous and non-squamous), regardless of EGFR mutation status, brain/liver metastases, or PD-L1 expression levels.

Balstilimab, a PD-1 inhibitor, reactivates exhausted T cells, restoring their anti-tumor function. Preclinical studies have shown strong efficacy against PD-L1-negative tumors, supporting its observed clinical benefit in both PD-L1-positive and negative cervical cancer. It is currently in a Phase III trial with botensilimab for gastric cancer, as well as multiple Phase II trials in other indications.

In June 2025, Agenus entered definitive agreements with Zydus Lifesciences to accelerate the development, expand manufacturing, and improve global access for botensilimab and balstilimab.

The anticipated launch of these emerging therapies are poised to transform the market landscape in the coming years. As these cutting-edge therapies continue to mature and gain regulatory approval, they are expected to reshape the PD-(L1) inhibitors market landscape, offering new standards of care and unlocking opportunities for medical innovation and economic growth.

To know more about PD-(L)1 inhibitors clinical trials, visit @ PD-L1 Inhibitors Mechanism of Action

PD-(L)1 Inhibitors Overview

Over the past decade, immune checkpoint inhibitors have transformed cancer treatment, providing patients with an alternative to chemotherapy or targeted therapies and offering the potential for long-term remission across multiple tumor types. The first clinically effective inhibitors targeted two immune checkpoint receptors: cytotoxic T-lymphocyte–associated antigen 4 (CTLA-4) and programmed death 1 (PD-1). These therapies benefit most solid tumors and certain hematologic malignancies, often through the use of one or both drug classes.

Initially approved for metastatic cancers, immune checkpoint inhibitors are now also used in early-stage disease for select cancers, such as triple-negative breast cancer and non-small-cell lung cancer. PD-1 is a T-cell checkpoint protein that functions as an “off switch,” preventing T cells from attacking other cells, especially when bound to PD-(L)1—a protein found on normal and cancer cells. Many cancer cells overexpress PD-(L)1 to evade immune detection. Monoclonal antibodies targeting PD-1 or PD-(L)1 disrupt this interaction, thereby enhancing the immune system’s ability to attack tumor cells.

PD-(L)1 Inhibitors Epidemiology Segmentation

The PD-(L)1 inhibitors market report proffers epidemiological analysis for the study period 2020–2034 in the 7MM segmented into:

- Total Incident Cases of Selected Indications for PD-(L)1 Inhibitors

Download the report to understand what epidemiologists are saying about PD-1/PD-L1 inhibitors patient trends in 7MM @ PD-(L)1 Inhibitors Patient Pool

| PD-(L)1 Inhibitors Report Metrics | Details |

| Study Period | 2020–2034 |

| PD-(L)1 Inhibitors Report Coverage | 7MM [the United States, the EU4 (Germany, France, Italy, and Spain), the United Kingdom, and Japan] |

| PD-(L)1 Inhibitors Market Size in the United States in 2024 | USD 28 Billion |

| Key Indications Covered in the Report | Melanoma, Non-small-cell lung cancer, Small-cell lung cancer (SCLC), Head and Neck Cancer, Colorectal Cancer, Renal Cell Carcinoma, Hepatocellular carcinoma (HCC), Triple Negative Breast Cancer, Gastric Cancer/Esophageal Cancer, Biliary Tract Cancer, Urothelial Carcinoma, Basal Cell Carcinoma, Cutaneous Squamous Cell Carcinoma, and others |

| Key PD-(L)1 Inhibitors Companies | Shanghai Henlius Biotech, Agenus, Arcus Biosciences, Pfizer, Merck, Ono Pharmaceuticals, Bristol Myers Squibb, Genentech, AstraZeneca, and others |

| Key PD-(L)1 Inhibitors | HLX43, Balstilimab, Zimberelimab, Sasanlimab, KEYTRUDA, OPDIVO, TECENTRIQ, BAVENCIO, IMFINZI, and others |

Scope of the PD-(L)1 Inhibitors Market Report

- PD-(L)1 Inhibitors Therapeutic Assessment: PD-(L)1 Inhibitors current marketed and emerging therapies

- PD-(L)1 Inhibitors Market Dynamics: Conjoint Analysis of Emerging PD-(L)1 Inhibitors Drugs

- Competitive Intelligence Analysis: SWOT analysis and Market entry strategies

- Unmet Needs, KOL’s views, Analyst’s views, PD-(L)1 Inhibitors Market Access and Reimbursement

Discover more about PD-1 vs PD-L1 inhibitors @ FDA Approved PD-1 PD-L1 Inhibitors List

Table of Contents

| 1 | KEY INSIGHTS |

| 2 | REPORT INTRODUCTION |

| 3 | EXECUTIVE SUMMARY OF PD-(L)1 INHIBITORS |

| 4 | KEY EVENTS |

| 5 | EPIDEMIOLOGY AND MARKET FORECAST METHODOLOGY |

| 6 | PD-(L)1 INHIBITORS MARKET OVERVIEW AT A GLANCE IN THE 7MM |

| 6.1 | MARKET SHARE (%) DISTRIBUTION BY INDICATIONS IN 2024 |

| 6.2 | MARKET SHARE (%) DISTRIBUTION BY INDICATIONS IN 2034 |

| 7 | PD-(L)1 INHIBITORS BACKGROUND AND OVERVIEW |

| 7.1 | INTRODUCTION |

| 7.2 | TYPES OF CHECKPOINT INHIBITORS |

| 7.3 | POTENTIAL OF PD1/PD-L1 INHIBITORS IN THE TREATMENT OF DIFFERENT CANCERS |

| 7.4 | PREDICTIVE BIOMARKERS |

| 7.5 | CLINICAL APPLICATIONS OF PD-(L)1 INHIBITORS |

| 8 | EPIDEMIOLOGY AND PATIENT POPULATION |

| 8.1 | ASSUMPTIONS AND RATIONALE: 7MM |

| 8.2 | TOTAL INCIDENT CASES OF SELECTED INDICATIONS FOR PD-(L)1 INHIBITORS IN THE 7MM |

| 9 | MARKETED DRUGS |

| 9.1 | KEY CROSS COMPETITION |

| 9.2 | TEVIMBRA (TISLELIZUMAB-JSGR): BEIGENE |

| 9.2.1 | Product Description |

| 9.2.2 | Regulatory Milestone |

| 9.2.3 | Pivotal Clinical Trial |

| 9.2.4 | Other Developmental Activities |

| 9.2.5 | Clinical Development |

| 9.2.5.1 | Clinical Trials Information |

| 9.2.6 | Safety and Efficacy |

| 9.3 | LOQTORZI (TORIPALIMAB): COHERUS BIOSCIENCES/SHANGHAI JUNSHI BIOSCIENCES |

| 9.4 | ZYNYZ (RETIFANLIMAB-DLWR): INCYTE |

| 9.5 | JEMPERLI (DOSTARLIMAB): GLAXOSMITHKLINE (GSK) |

| 9.6 | LIBTAYO (CEMIPLIMAB-RWLC): REGENERON/SANOFI |

| 9.7 | IMFINZI (DURVALUMAB): ASTRAZENECA |

| 9.8 | BAVENCIO (AVELUMAB): MERCK |

| 9.9 | TECENTRIQ (ATEZOLIZUMAB): GENENTECH/HOFFMANN-LA ROCHE |

| 9.10 | OPDIVO (NIVOLUMAB): BRISTOL-MYERS SQUIBB AND ONO PHARMACEUTICAL |

| 9.11 | KEYTRUDA (PEMBROLIZUMAB): MERCK |

| 10 | EMERGING DRUGS |

| 10.1 | KEY CROSS COMPETITION |

| 10.2 | SASANLIMAB: PFIZER |

| 10.2.1 | Product Description |

| 10.2.2 | Other Developmental Activities |

| 10.2.3 | Clinical Development |

| 10.2.3.1 | Clinical Trials Information |

| 10.2.4 | Safety and Efficacy |

| 10.3 | ZIMBERELIMAB: ARCUS BIOSCIENCES |

| 10.4 | BALSTILIMAB: AGENUS |

| List to be continued in the report.. | |

| 11 | PD-(L)1 INHIBITORS: THE 7MM ANALYSIS |

| 11.1 | KEY FINDINGS |

| 11.2 | MARKET OUTLOOK |

| 11.3 | KEY MARKET FORECAST ASSUMPTIONS |

| 11.3.1 | Cost Assumptions and Rebate |

| 11.3.2 | Pricing Trends |

| 11.3.3 | Analogue Assessment |

| 11.3.4 | Launch Year and Therapy Uptake |

| 11.4 | TOTAL MARKET SIZE OF PD-(L)1 IN THE 7MM |

| 11.5 | MARKET SIZE BY INDICATIONS IN THE 7MM |

| 11.6 | MARKET SIZE BY THERAPIES IN THE 7MM |

| 11.7 | THE UNITED STATES MARKET SIZE |

| 11.8 | EU4 AND THE UK MARKET SIZE |

| 11.9 | JAPAN MARKET SIZE |

| 12 | UNMET NEEDS |

| 13 | SWOT ANALYSIS |

| 14 | KOL VIEWS |

| 15 | MARKET ACCESS AND REIMBURSEMENT |

| 16 | ABBREVIATIONS |

| 17 | BIBLIOGRAPHY |

| 18 | REPORT METHODOLOGY |

Related Reports

Basal Cell Carcinoma Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key basal cell carcinoma companies, including MedC Biopharma Corporation, AiViva BioPharma, MediWound, Kintara Therapeutics, IO Biotech, Sirnaomics, Aresus Pharma, Epitome Pharmaceuticals, Transgene, Senhwa Biosciences, Palvella Therapeutics, Suzhou Kintor Pharmaceuticals, Leaf Vertical, among others.

Cutaneous Squamous Cell Carcinoma Market

Cutaneous Squamous Cell Carcinoma Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key cutaneous squamous cell carcinoma companies, including Incyte Corporation, Shanghai Henlius Biotech, Novartis, Rakuten Medical, Morphogenesis, Genentech, Berg Pharma, I-MAB Biopharma, Roche, Genexine, CureVac, among others.

Colorectal Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key colorectal cancer companies, including Mirati Therapeutics, Exelixis, Enterome, Arcus Biosciences, Lyell Immunopharma, AstraZeneca, Novartis Pharmaceuticals, Surgimab, Numab Therapeutics, SOTIO Biotech, Amgen, Sichuan Baili Pharmaceutical, Qilu Pharmaceutical, Bristol-Myers Squibb, NGM Biopharmaceuticals, Takeda, PureTech, Pfizer, Kezar Life Sciences, Salubris Biotherapeutics, among others.

Non-small Cell Lung Cancer Market

Non-small Cell Lung Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key NSCLC companies, including AstraZeneca, Boehringer Ingelheim, Takeda, Johnson & Johnson Innovative Medicine, Eli Lilly and Company, Merck, Bristol-Myers Squibb, Roche, Shanghai Henlius Biotech, AbbVie, Daiichi Sankyo, Nuvation Bio, PDC*line Pharma, Moderna Therapeutics, Pfizer, GSK, Gilead Sciences, BieGene, Nuvalent, among others.

Gastric Cancer Market Insights, Epidemiology, and Market Forecast – 2034 report deliver an in-depth understanding of the disease, historical and forecasted epidemiology, as well as the market trends, market drivers, market barriers, and key gastric cancer companies, including Hanmi Pharmaceuticals, Merck, Minneamrita Therapeutics, Taiho Pharmaceuticals, Bayer, among others.

Oncology Conference Coverage Services

DelveInsight’s Oncology Conference Coverage Services offer a thorough analysis of outcomes from major events like ASCO, ESMO, ASH, AACR, ASTRO, SOHO, SITC, the European CAR T-cell Meeting, and IASLC. This detailed examination provides businesses with essential insights for competitive intelligence and market trend forecasting, supporting the formulation of future strategies.

Other Business Pharmaceutical Consulting Services

Healthcare Conference Coverage

Discover how a mid-pharma client gained a level of confidence in their soon-to-be partner for manufacturing their therapeutics by downloading our Due Diligence Case Study

About DelveInsight

DelveInsight is a leading Business Consultant and Market Research firm focused exclusively on life sciences. It supports pharma companies by providing comprehensive end-to-end solutions to improve their performance. Get hassle-free access to all the healthcare and pharma market research reports through our subscription-based platform PharmDelve.

Connect with us on LinkedIn|Facebook|Twitter

Contact Us Shruti Thakur info@delveinsight.com +14699457679 www.delveinsight.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.